Dividend Yield Formula + Calculator

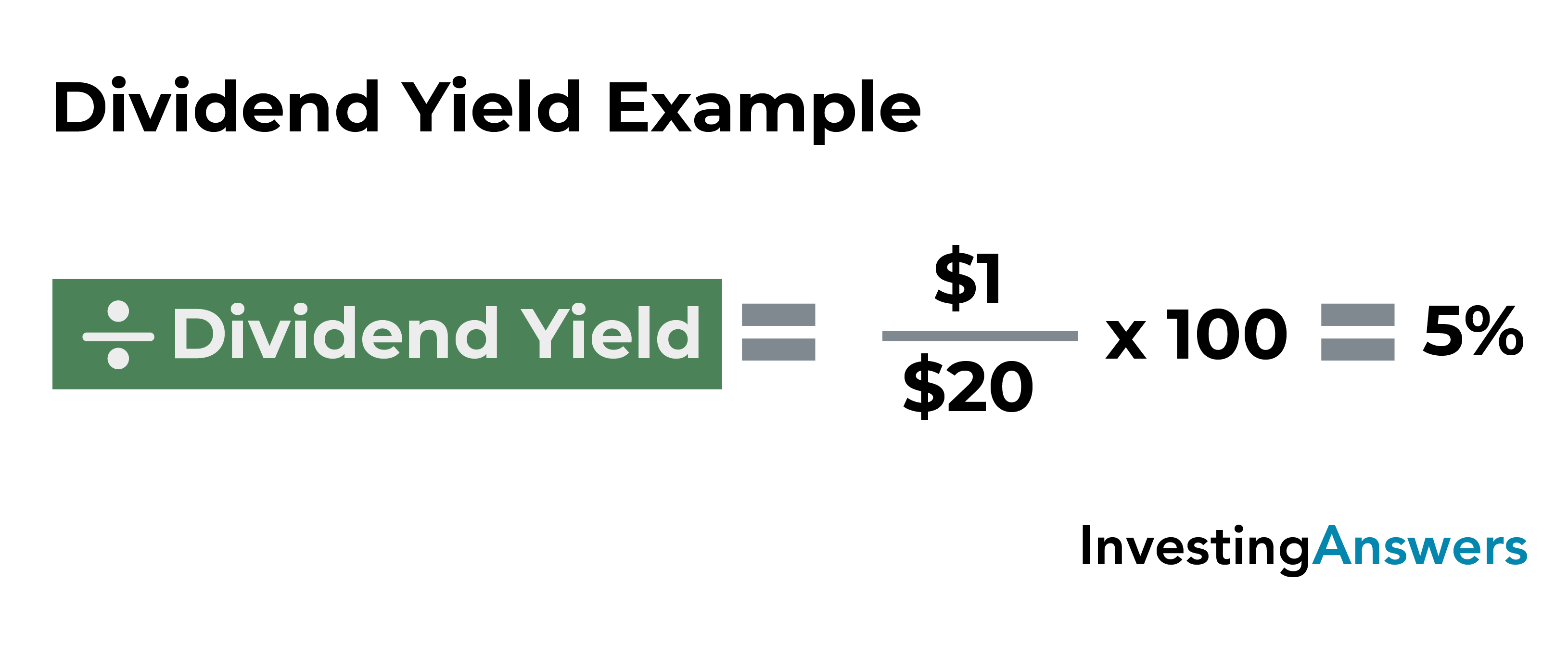

This is a good sign of steady company growth rather than a precipitous drop in overall stock price. For example, if a company is trading at $10.00 in the market and issues annual dividend per share (DPS) of $1.00, the company’s dividend yield is equal to 10%. Companies generally pay out dividends based on the number of shares you own, not the value of shares you own, though.

You’re our first priority.Every time.

- For example, the average dividend yield in the market can be very high amongst real estate investment trusts (REITs).

- This dividend calculator is a simple tool that lets you calculate how much money you will get from a dividend when you invest in a dividend-paying stock.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- Those factors will ultimately determine the company’s ability to continue paying its dividend.

When deciding how to calculate the dividend yield, an investor should look at the history of dividend payments to decide which method will give the most accurate results. Because dividends are paid quarterly, many investors will take the last quarterly dividend, multiply it by four, and use the product as the annual dividend for the yield calculation. This approach will reflect any recent changes in the dividend, but not all companies pay an even quarterly dividend. Some firms, especially outside the U.S., pay a small quarterly dividend with a large annual dividend. If the dividend calculation is performed after the large dividend distribution, it will give an inflated yield. The thing about stocks is that they can vary greatly in value – some may cost a couple of dollars while others reach prices in the hundreds.

How to Calculate Annual Dividends

While a company may be paying high dividends to its stakeholders over a steady period, the case may not always be the same. Yields for the current year are generally estimated from the prior year’s yield or latest quarter yield (annualized for the year) and division with the current share price. Currently, there are 65 companies that meet the basic criteria of increasing their dividend for a quarter century straight. They include big names in energy, industrial production, real estate, defense contractors, and more. For investors looking for steady dividends, this list may be a good place to start. • Understanding the difference between dividend yield and dividend rate is essential, as dividend yield is a ratio while dividend rate is expressed in dollar amounts.

Using the MarketBeat Dividend Yield Calculator

However, those are the yields from ordinary dividends, which are different than qualified dividends in that the former is taxed as regular income while the latter is taxed as capital gains. For instance, rapid changes in a stock price can distort the dividend yield. And analyses of a company’s historical performance can only tell you so much about the future. Some investors prefer a measure called the dividend payout ratio to analyze what might happen going forward. When buying stocks, and those specifically with dividend payments, it is common practice to reinvest – i.e., buying even more shares with the money you get from the dividends. That is why some people may refer to the dividend calculator as dividend reinvestment calculator.

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. However, the cause of each company’s yield increase determines whether the increase should be determined positively or negatively. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

A high dividend yield can be considered to be evidence that a stock is underpriced or that the company has fallen on hard times and future dividends will not be as high as previous ones. Similarly a low dividend yield can be considered evidence that the stock is overpriced or that future dividends might be higher. In contrast some investors may find a higher dividend yield unattractive, perhaps because it increases their tax bill. This is especially important because some companies pay uneven dividends, with the higher payouts toward the end of the year, for example. So you wouldn’t want to simply add up the last few dividend payments without checking to make sure the total represents an accurate annual dividend amount. Investors can calculate the annual dividend of a given company by looking at its annual report, or its quarterly report, finding the dividend payout per quarter, and multiplying that number by four.

However, if one company’s stock is valued at $100 and the other’s is valued at $300, one company is paying significantly more relative to what the company may be worth. Conversely, another thing companies can do to reward shareholders is buy back stock, a move that’s designed to raise share prices. If a company does that without raising the dividend, the yield could go down even as investors are smiling over the gains in their portfolios. The essential, unchanging part of the dividend definition is that dividends are paid out per share of the stock.

Dividends are a portion of a company’s profits that it returns to shareholders. Dividends are offered to investors to reward them for owning shares of the company, and also to distribute excess cash that isn’t being reinvested back into the company. Yield-oriented investors will generally look for companies that offer high dividend yields, but it is important to dig deeper in order to understand the circumstances leading to the high yield.

A yield trap is when a stock’s high dividend yield doesn’t offer any advantages. This can be due to multiple factors, but one way it happens is if a company’s stock price falls faster than its earnings. The falling share price could make the company’s dividend payouts appear more lucrative than they actually are since the company’s failing earnings might also mean the company will soon cut its dividend. Popularly known as « Forward Dividend yield, » it has to be used cautiously since these estimates will always be uncertain.

Company ABC and Company PQR are valued at $5 billion, half of which comes from 25 million publicly held shares worth $100 each. Also, assuming that at the end of Year 1, the two companies earn 10% of accountants their value or $1 billion in revenue. Company ABC decides to pay half of these earnings ($500 million) in dividends to its shareholders, paying $10 for each share to have a dividend yield of 10%.